2018 ushered in a new round of out-of-stock price increases

2017/12/27 16:36:27

2017/12/27 16:36:27

In 2017, the price rise of out of stock has been higher and higher. Now that this year has come to an end, MOSFET and resistor set off a new round of shortage price rise tide again. In just two days, Jiangsu Changdian science and technology once again issued a price increase notice, appropriately raising the price of MOSFET products. Guoju also informed that the general products of thick film resistors would stop receiving orders from now on...

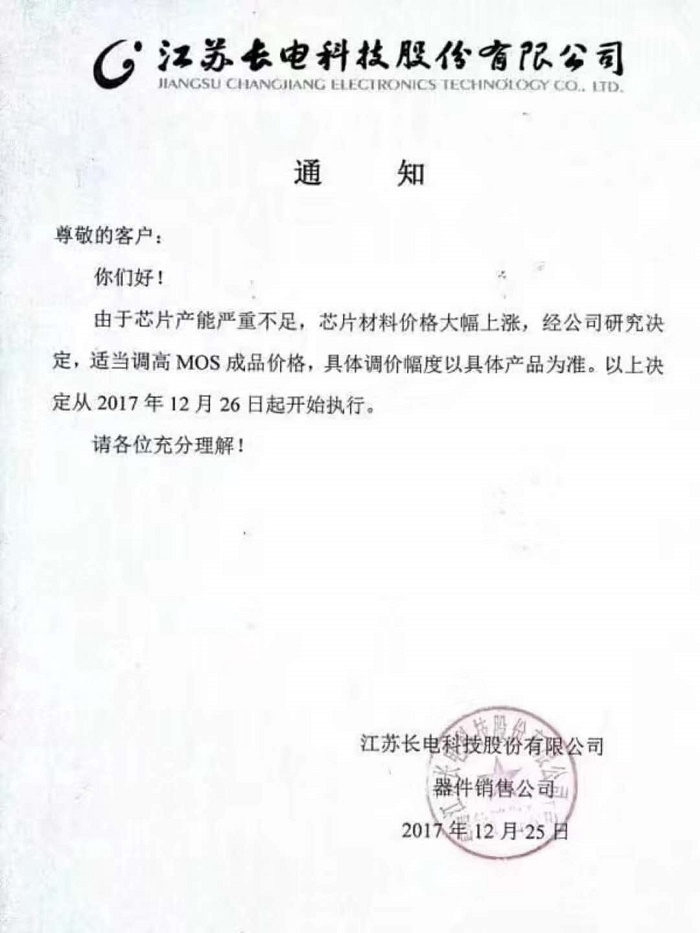

On December 25, Jiangsu Changdian Technology Co., Ltd. issued a price increase notice to its customers, saying that due to the serious shortage of chip production capacity, the price of chip materials has risen sharply. After research and decision of the company, the price of MOSFET products will be appropriately increased, and the specific price adjustment range is subject to the specific products. The above decisions will be implemented from December 26, 2017.

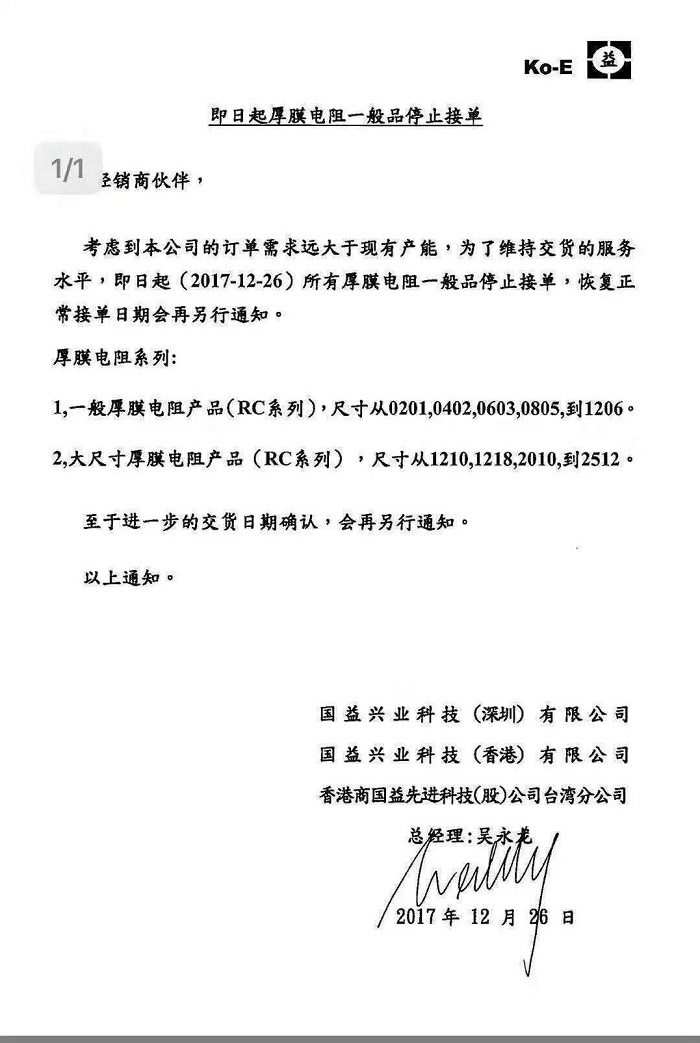

Today (December 26), Guoju again issued a notice to its dealers, that is to say, general thick film resistor products will stop receiving orders. According to the notice, considering that the company's order demand is far greater than the existing capacity, in order to maintain the service level of delivery, from now on (December 26, 2017), all the general thick film resistor products will stop receiving orders, and the date of normal order receiving will be further notified.

List of thick film resistors: general thick film resistor products (RC Series), sizes from 0201, 0402, 0603, 0805 to 1206. Large size thick film resistor products (RC Series), sizes from 1210, 1218, 2010 to 2512.

In terms of MOSFET, Changdian technology has issued a notice on September 1, 2017 to increase the prices of all MOSFETs by 20% and the cumulative increase has reached 50%. After the price rise of Changdian MOSFET, other suppliers immediately and comprehensively followed up the price increase, including the MOSFET suppliers of Dazhong, Nixon and Fuding.

Now, Changdian technology is rising again, and other manufacturers may follow suit. It is reported that at present, semiconductor power device manufacturers in the industry have decided to raise the prices of various MOSFET series products from 2018, and the price increase rate is basically maintained at about 10%.

The following is the schedule of MOSFET price increase this year (incomplete statistics):

On September 1, 2017, Changdian technology increased the price of all field-effect transistor by 20%; on September 1, 2017, the price of Xi'an Houyi semiconductor products increased by more than 10%; on September 19, 2017, Changdian technology increased the price of MOSFET products again, ranging from 10% to 30%; on October 20, 2017, Leshan wireless informed all products to increase more than 10% from December 1; On November 1, 2017, the core power unit increased by more than 10%; on December 6, 2017, Wuxi new clean energy informed about the price increase of about 10% after the new year's day; on December 25, 2017, Changdian technology once again informed that the price of MOSFET products should be appropriately increased from December 26, 2017.

On the one hand, the production capacity of large factories has shifted to high-end products, resulting in serious shortage of medium and low-level products. On the other hand, the production capacity of 8-inch wafer factories is tight and the silicon wafer capacity is insufficient. Generally speaking, the delivery time of MOSFET is about 8 weeks. Now, the order delivery time of medium and low-level MOSFET products has been extended to more than 3 months. In early December, DIGITIMES reported that high-voltage MOSFET chip solutions had been out of stock for more than a year. In the first half of 2018, the global supply and demand gap of high-voltage MOSFET chip market still reached 30%, which may be difficult to solve in the short term.

Recently, international MOSFET chip suppliers have approached cross-strait wafer foundry and packaging and testing plants to discuss cooperation, hoping to expand the technology and capacity cooperation space in high-voltage MOSFET chip product line. Among them, the world's advanced technology has been contracted by customers for production, and TSMC's 6-inch factory in Shanghai has also attracted customers. As for Jiemin, Yichang and other Taiwan series sealing and testing plants, their production capacity in 2018 has been reserved by major international chip manufacturers.

Nowadays, the supply gap of MOSFET has covered high, medium and low voltage. Recently, it includes large and medium-sized, Fuding, Nixon and other Taiwan based MOSFET chip suppliers, which have called out that the current customer demand is unprecedented in the past 20 years. Market forecast that the supply and demand gap in MOSFET market is up to 30%, and the supply shortage will continue to 2018, and there is still room for price rise. The order visibility of MOSFET factory is seen to the first quarter of next year.

As for resistance, Guoju is a leading resistance enterprise with a monthly production capacity of more than 90 billion pieces. Now it has stopped receiving orders due to the shortage of supply. It can be seen that the market demand for resistors is still strong. In the first ten days of 2017, the price of resistance also increased. Guoju, housheng, huaxinke, wangquan, Fenghua Gaoke, Dayi and other original manufacturers announced that the price of chip resistor products increased, with an increase of about 10%.

The following is the schedule of resistance price increase this year (incomplete statistics):

On February 25, 2017, housheng issued a notice to increase the price of some resistor products by about 10% from March 1; on April 19, 2017, Guoju issued a notice to adjust the price of chip resistor r-chip and chip capacitor MLCC from April 19, 2017; on April 20, 2017, Fenghua High Tech Co., Ltd. issued a notice to adjust the price of chip resistors from April 21; On July 10, 2017, Dayi issued a notice, saying that it would suspend the orders of 0603-1206 chip resistor products from now on, and would not resume receiving orders until the selling price was reviewed.

Originally, the gap between supply and demand in the resistance market in the second half of the year has eased, but recently, it is reported that resistance prices are also brewing. Some chip resistance manufacturers pointed out that in the past two months, the basic supply of ceramics in the upstream has become tense. If the trend remains unchanged, there will be room for price increase next year.

WINSOK Semiconductor main business medium and low pressure MOSFET、IC、IGBT,Package with SOT-23N package MOSFET/OT-23-3L package MOSFET/SOT-223 package MOSFET/SOT-23-6L package MOSFET/SOT-89 package MOSFET/SOP-8 package MOSFET/TSSOP-8 package MOSFET/DFN3X3-8L package MOSFET/TO-252 package MOSFET/TO-220 package MOSFET/TO-251 package MOSFET,etc.

-

A record of global semiconductor equipment shipments increased 40% year

The International Semiconductor Industry Association (SEMI) announced in December last year, the North American semiconductor equipment shipments amounted to US $2 billion 390 million, the monthly increase of 16.3%, the annual increase of 27.7%, hit a…

2018-01-31More

-

The largest M&A transaction in the chip industry will be completed: Qualcomm acquires NXP

Brussels in the next week will be approved by the Qualcomm Corp for $47 billion acquisition of Holland NXP company (NXP), marking the chip industrys largest acquisition was completed.

2018-01-11More

-

Holding up the electronic information industry, observation of the semiconductor market status quo

WINSOK semiconductor has observed that since 1990s, the development of communications equipment, consumer electronics, computers, Internet applications, automotive electronics, set-top boxes and other industries has been developing rapidly.

2017-06-10More